tax shield formula excel

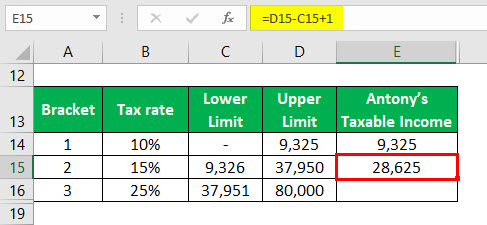

When a company has debt the interest it pays on that debt that is tax-deductible creating interest tax shields that have value. VLOOKUP inc rates31 inc - VLOOKUP inc rates11 VLOOKUP inc rates21.

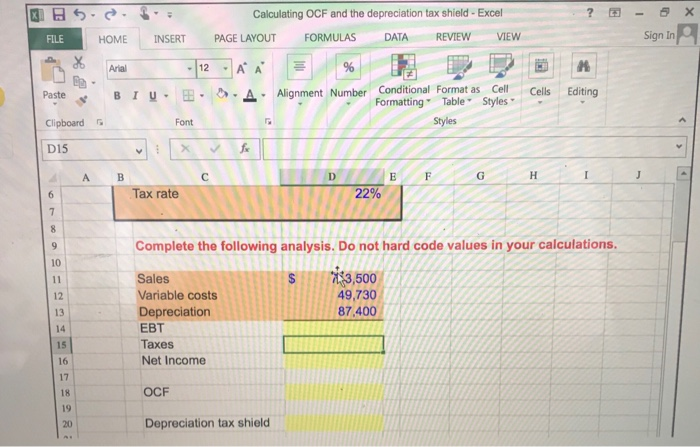

Solved Calculating Ocf And The Depreciation Tax Shield Excel Chegg Com

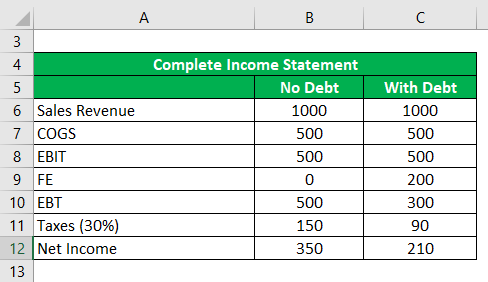

This is equivalent to the 800000 interest expense multiplied by 35.

. It needs to multiply all 50000 by 10 because all 50000 is taxed by at least 10. Interest Tax Shield Example A company carries a debt balance of 8000000 with a 10 cost of debt and a 35 tax rate. Calculate the present value PV of each interest tax shield amount by dividing the tax shield value by 1 cost of debt period number.

These two equations are essentially the same. The effect of a tax shield can be determined using a formula. In this condition you can easily calculate the sales tax by multiplying the price and tax rate.

The effect of a tax shield can be determined using a formula. Interest Tax Shield Interest Expense Deduction x Effective Tax Rate Interest Tax Shield 4m x 21 840k. Interest Tax Shield Formula Average debt Cost of debt Tax rate.

In our case the entire sixth item is 110130335000040103 7889. The PV of the interest tax shield can be calculated by discounting the annual tax savings at the pre-tax cost of debt which we are. How is depreciation tax shield calculated in Excel.

In the line for the initial cost. Regardless of payment method you will need to create a depreciation table for Tax depreciation. Where CF is the after-tax operating cash flow CI is the pre-tax cash inflow CO is pre-tax cash outflow t is the tax rate and D is the depreciation expense.

The expression CI CO D in the first equation represents the taxable income which when. Tax Shield Value of Tax-Deductible Expense x Tax Rate So for instance if you have 1000 in mortgage interest and your tax. Tax Shield Formula Sum of Tax-Deductible Expenses Tax rate.

And the same for 45 on anything above 150k. Tax Shield Deduction x Tax Rate To learn more launch our free accounting and finance courses. R te R tf 1 t R te 010 1 028 R te 010 072 R te 01389 or 1389 Thus the taxable bond in case of Investor A must contain a yield greater than 1389 which would eventually be more profitable after deducting his 28 tax bracket.

Calculating the tax shield can be simplified by using this formula. This is usually the deduction multiplied by the tax rate. The formula in G5 is.

Case 1 Taxable Income with Depreciation Expense TAX to be Paid over Income Revenues- Operating Expenses-Depreciation-Interest Expenses x tax rate or EBT x tax rate. Additional Rate 15000001 upward 45 I can see the following for the basic rate tax as. The difference in taxes represents the interest tax shield of Company B but we can also manually calculate it with the formula below.

In the DCF analysis the ITS are baked in by including the tax-effected cost of debt in the WACC used to discount free cash flows FCF. In this condition you can apply the Vlookup function to calculate the income tax for a certain income in Excel. Multiply the interest expense by the tax rate assumptions to calculate the tax shield.

CF CI CO CI CO D t. Its formula examples and calculation with practical examples𝐖𝐡𝐚𝐭 𝐢𝐬 𝐓𝐚𝐱 𝐒. Tax Equivalent Yield for Investor A is Calculated as.

The following is the Sum of Tax-deductible Expenses Therefore the calculation of Tax Shield is as follows Tax Shield Formula 10000 18000 2000 40 The Tax Shield will be Tax Shield 12000. This is simply to bring the PV of tax shield loss to today. The most important financing side effect is the interest tax shield ITS.

This is usually the deduction multiplied by the tax rate. Interest Tax Shield Interest Expense x Tax Rate. To that we need to add 10 of 13100 50000-36900 because the differential rate of that bracket is 10 25-15.

In this video on Tax Shield we are going to learn what is tax shield. How to calculate NPV. Present Value of Tax Shield Interest Expense Debt Rate Tax Rate Adjusted Present Value APV PV of Cash Flows Present Value of Tax Shield.

To calculate total income tax based on multiple tax brackets you can use VLOOKUP and a rate table structured as shown in the example. How to calculate after tax salvage valueCORRECTION. If Taxable Income above 32k but below 150k deduct 40.

Layout the Cash Flow Analysis. Depreciation Tax Shield Formula Depreciation expense Tax rate. To that we need Excel to add 5 of 40925 50000-9075 because the differential rate of the next bracket is 5 15-10.

PV of Tax Shield. Now layout the two discounted cash flow analyses. Tax Shield Formula Step By Calculation With Examples.

The first will be for the lease and the second for buying. If B8. NPV -200000 109421 - 7479 26296 57273 - 7889 -.

How to calculate tax shield due to depreciation. Select the cell you will place the calculated result enter the formula B1B2 B1 is the price exclusive of tax and B2 is the tax rate and press the Enter key. Select the cell you will place the calculated result at enter the formula VLOOKUPC1A5D124TRUEC1.

Put all items together. Based on the information do the calculation of the tax shield enjoyed by the company. Frequently you can get the tax table with cumulative tax for each tax bracket.

Tax Shield Deduction x Tax Rate More Free Templates For more resources check out our business templates library to download numerous free Excel modeling PowerPoint presentation and Word document templates. But as soon as i try to qualify a range ie. We have a negative sign in front of it since we lose it.

Dont forget to account for the Tax shield and of course gainloss on the assets.

Tax Shield Formula Step By Step Calculation With Examples

Solved Calculating Ocf And The Depreciation Tax Shield Excel Chegg Com

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Interest Tax Shield Formula And Excel Calculator

Effective Tax Rate Formula Calculator Excel Template

Printable Free Cash Flow Forecast Templates Smartsheet Cost Forecasting Template Pdf Cash Flow Budget Forecasting Personal Finance Budget

Wacc Formula Cost Of Capital Financial Management Charts And Graphs

Using Excel For Tax Calcs Jun 2019 Youtube

Interest Tax Shield Formula And Excel Calculator

Tax Shield Formula How To Calculate Tax Shield With Example

Cost Of Debt Kd Pre Tax And After Tax Formula With Excel Calculator

Cash Flow After Deprecition And Tax 2 Depreciation Tax Shield Youtube

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Array Formulas And Functions In Excel Examples And Guidelines Excel Excel Templates Microsoft Excel